Simplify your GST compliance with our integrated solutions. We offer user-friendly tools and expert guidance to ensure accurate and hassle-free tax submissions. Gain insights into your tax liabilities and transactions with real-time reporting.

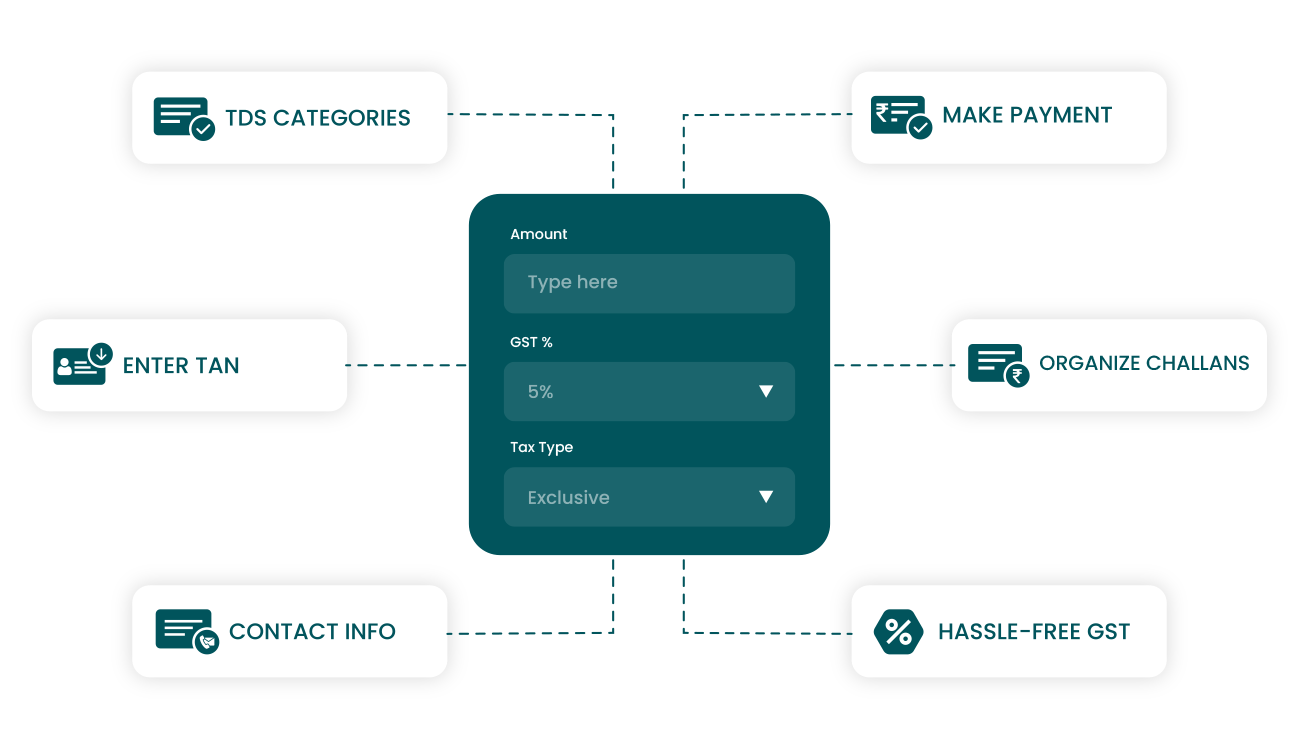

At Quiken Techno, we understand the vital role seamless tax management plays in the world of Payment Gateways. Our GST Solutions are designed to enhance your platform's efficiency. We provide real-time tax calculation, automated invoicing, and comprehensive reporting to ensure compliance and accuracy in all transactions.

Our team of tax experts diligently keeps up-to-date with the ever-evolving tax regulations and ensures your Payment Gateway remains in full compliance. With our comprehensive GST Solutions, you can confidently offer your clients a reliable and user-friendly payment experience, ultimately boosting customer trust, satisfaction, and growth.

GSTR simplifies intricate tax matters, ensuring seamless compliance for your business success with a full fledge.

Sign Up

Our TDS solutions are designed to simplify the complex landscape of tax deducted at source. We offer comprehensive services that ensure compliance with all regulatory requirements, making the process hassle-free for your business.

Achieving tax compliance is essential for any business. Our tax compliance services cover a wide spectrum of tax-related responsibilities, and we ensure that you will comply with all legal obligations while optimizing your tax position at the same time.